40 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest

Mortgage Rates: Compare Today's Rates | Bankrate Sep 20, 2022 · For example, if you have a fixed-rate mortgage with a 5.2 percent interest rate and prevailing rates shoot up to 7 percent the next week, year or decade, your interest rate is locked in, so you ... Reserve Bank of India - Notifications Oct 26, 2021 · For swaps that pay or receive a fixed or floating interest rate against some other reference price, e.g. a stock index, the interest rate component shall be slotted into the appropriate re-pricing maturity category, with the equity …

Latest News - News Viewer - MarketWatch Get the latest stock market, financial and business news from MarketWatch.

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest

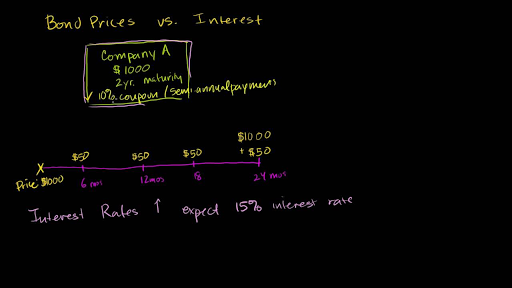

If the yield on a fixed coupon bond goes up, does the borrower have to ... The borrower does not pay more interest. "…the yield on a fixed coupon bond goes up…" means that the price of the bond declines. If the borrower borrows $1 billion at a rate of 3%, that means (generally, more-or-less) that the borrower pays $15 million twice per year as interest. Certificates of deposit (CDs) | Fixed income investment | Fidelity Brokered CD vs. bank CD A brokered CD is similar to a bank CD in many ways. Both pay a set interest rate that is generally higher than a regular savings account. Both are debt obligations of an issuing bank and both repay your principal with interest if they’re held to maturity.More important, both are FDIC-insured up to $250,000 (per account owner, per issuer), a coverage … If the yield on a fixed-coupon bond goes up, does the borrower have to ... If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? Most studied answer No, the price goes down. The payments are fixed. FROM THE STUDY SET Investing View this set Other answers from study sets If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? No, the price goes down.

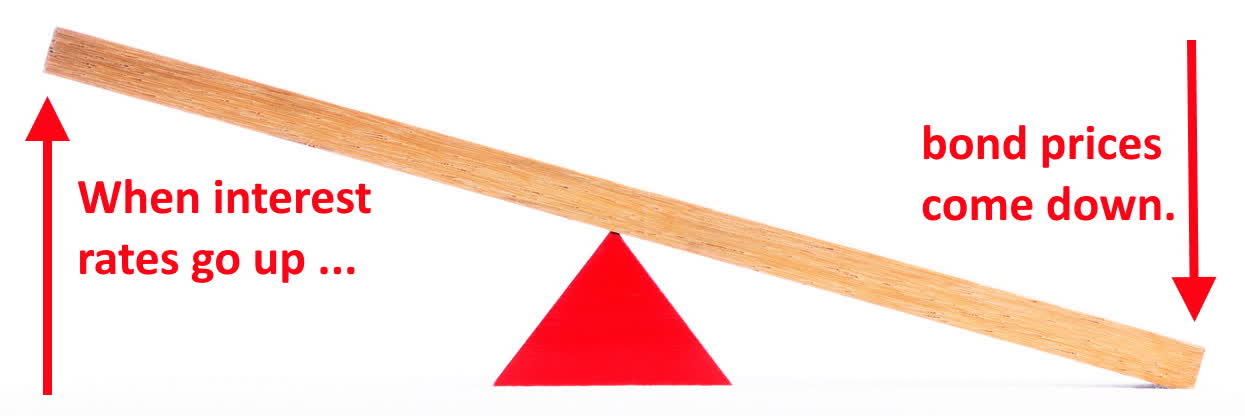

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest. What Is the Inverse Relationship Between Bond Price and Bond Yield? The yield is its rate of return considering changes in price and after discounting the bond's cashflows at prevailing market rates. Bond yield and price are inversely related. Thus, as the price goes up, the yield decreases, and vice versa. This relationship exists because the bond's coupon rate is fixed, which requires the price in ... Mortgage-backed security - Wikipedia A mortgage-backed security (MBS) is a type of asset-backed security (an 'instrument') which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals (a government agency or investment bank) that securitizes, or packages, the loans together into a security that investors can buy.Bonds securitizing mortgages are usually … Why does the borrower pay more interest if the yield on a fixed coupon ... The borrower does not pay more interest in a fixed coupon, even if the yield goes up. Essentially, if the yield goes up, it means that the market price has gone down, below the face value (or earlier market value) of the bond. If a bond is issued at 100 and coupon is 4 annually, yield is 4% p.a.. Bond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

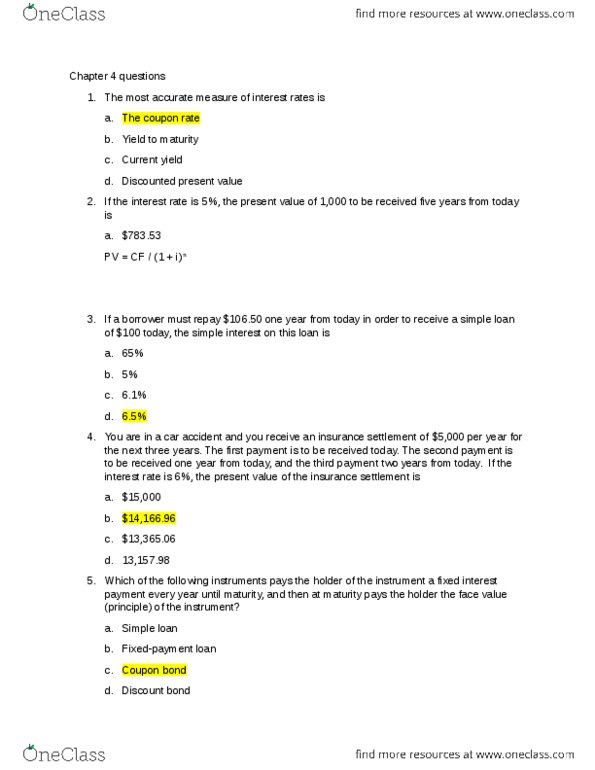

Bond Coupon Interest Rate: How It Affects Price - Investopedia Most bonds have fixed coupon rates, meaning that no matter what the national interest rate may be—and regardless of market fluctuation—the annual coupon payments remain static. 2 For... KNOWLEDGE CHECK If the yield on a fixed-coupon bond goes up, does the ... The correct option is c). No, the price goes down. The payments are fixed. Explanation: The Yield and Price of a fixed-coupon bond have an inverse relationship where if the Yield goes up, the Price of the bond goes down. Since Yield reflects the required rate of return investors expect based on the risk of the bond, therefore, its price shows that. Solved If the yield on a fixed-coupon 'bond goes up, does - Chegg If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? No, the price goes up. The yield goes up. Yes, the price goes down. The coupon payments go up. Yes, the price goes up. The yield goes down. No, the price goes down. The payments are fixed. Solved KNOWLEDGE CHECK If the yield on a fixed-coupon bond | Chegg.com KNOWLEDGE CHECK If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? Yes, the price goes up. The yield goes down No, the price goes up. The yield goes up. No, the price goes down. The payments are fixed. Yes, the price goes down. The coupon payments go up.

Finance - Wikipedia Finance is the study and discipline of money, currency and capital assets.It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly … D7223F5B-B2AE-489C-8162-07DB6623D3E9.jpeg - KNOWLEDGE CH... KNOWLEDGE CH ECK If the yield on a fixed—coupon bond goes up, does the borrower have to pay more interest? Yes, Study Resources. Main Menu; by School; ... KNOWLEDGE CH ECK If the yield on a fixed—coupon bond goes up, does the borrower have to pay more. ... 90 spend a little more time with the kids Paloma would fill in for him at his. When is a bond's coupon rate and yield to maturity the same? - Investopedia Jan 13, 2022 · For example, if a company issues a $1,000 bond with a 4% interest rate, but the government subsequently raises the minimum interest rate to 5%, then any new bonds being issued have higher coupon ... Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond that issues 3% coupon payments may now be "outdated" if interest rates have increased to 5%. To compensate for this, the bond will be sold at a discount in secondary market.

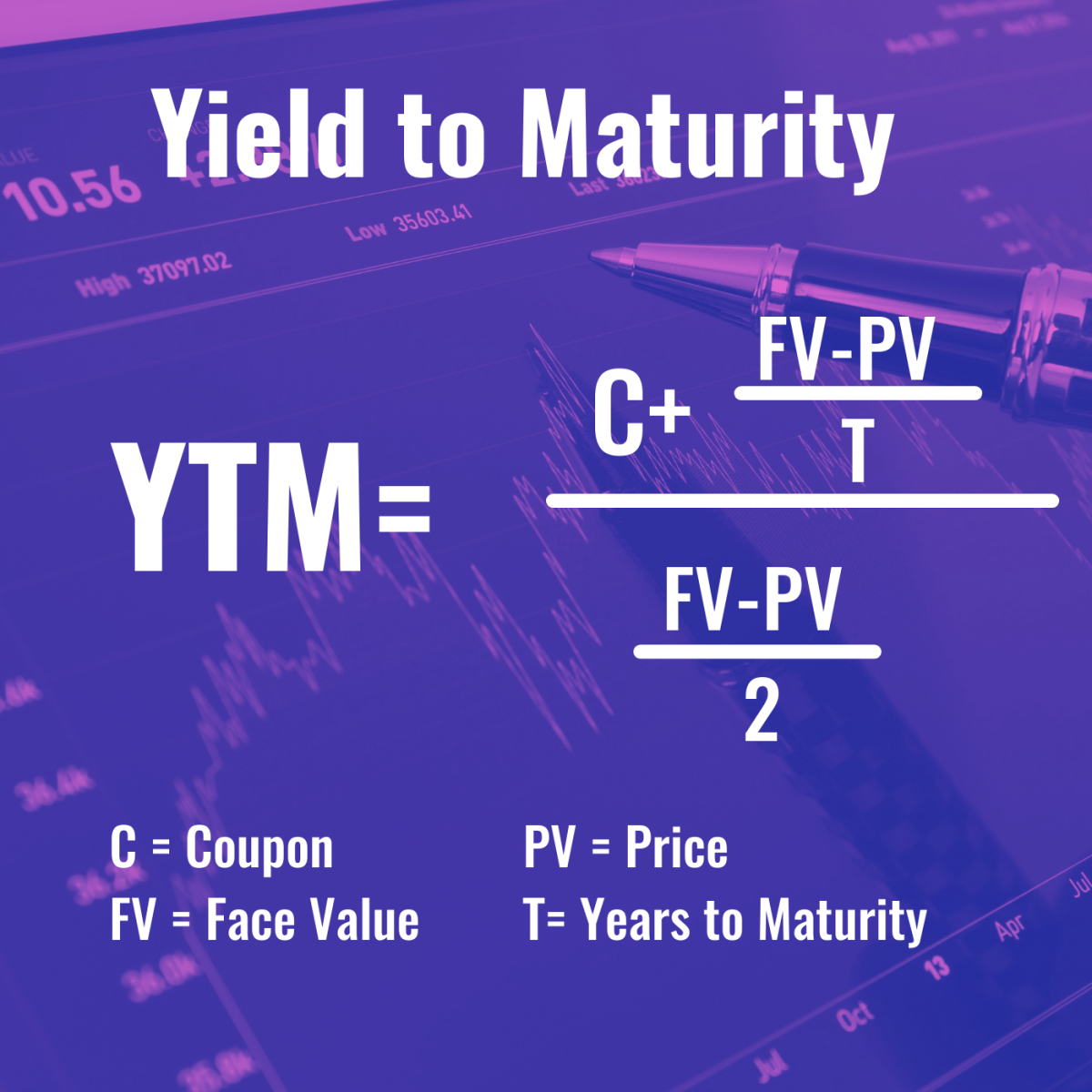

Bond Yield: What It Is, Why It Matters, and How It's Calculated Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

If the yield on a fixed-coupon 'bond goes up, does the...get 5 No,... If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? a. No, the price goes up. The yield goes up. b. Yes, the price goes down. The coupon payments go up. c. Yes, the price goes up. The yield goes down. d. No, the price goes down. The payments are fixed. Sep 16 2022 | 09:58 AM | Solved

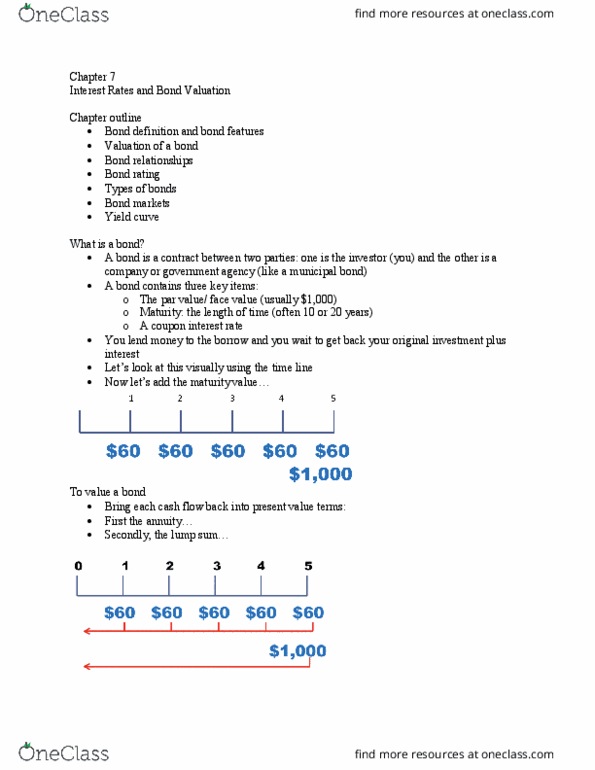

Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time.The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods.

Investing Flashcards | Quizlet If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? No, the price goes down. ... 4,000 million Peruvian sol. Which one of the following actors benefits when interest rates go up? An investor who is about to buy bonds. ... The bond with the highest yield if the two bonds have the same maturity date.

If the yield on a fixed-coupon 'bond goes up, does the borrower have to ... If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? No, the price goes up. The yield goes up. Yes, the price goes down. The coupon payments go up. Yes, the price goes up. The yield goes down. No, the price goes down. The payments are fixed. 1 Approved Answer Mohammad Z answered on March 27, 2021

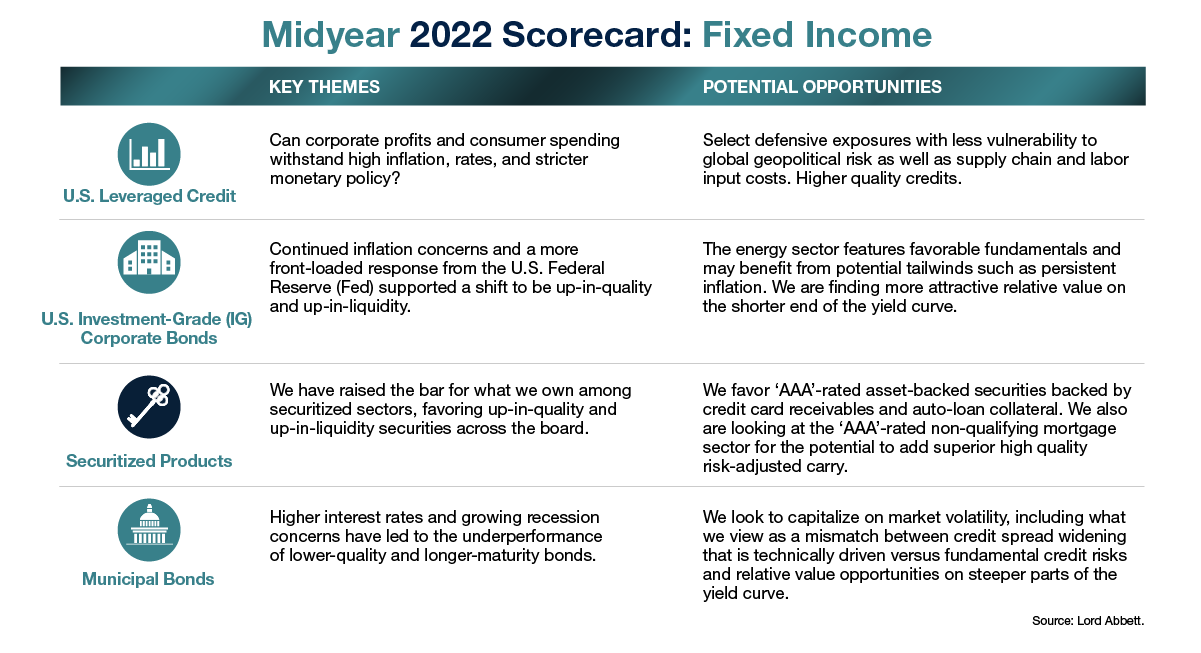

Bond Economics: The Yield Curve And Bank Net Interest Margins Deposits that pay a floating rate, and money market instruments issued by the bank have an increasing interest cost. Long-dated fixed coupon funding — term deposits, bonds issued by the bank — are unaffected. The standard story is that "banks borrow short and lend long," which people translate into: bank assets are fixed interest loans ...

KNOWLEDGE CHECK If the yield on a fixed-coupon bond goes up, does the ... KNOWLEDGE CHECK If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? Yes, the price goes up. The yield goes down No, the price goes up. The yield goes up. No, the price goes down. The payments are fixed. Yes, the…

If the yield on a fixed coupon bond goes up If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? No, the price goes up. The yield goes up. Yes, the price goes down. The coupon payments go up. Yes, the price goes up. The yield goes down. No, the price goes down. The payments are fixed. Answer Option d is the correct option No, the price goes down.

If the yield on a fixed-coupon bond goes up, does the borrower have to ... If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? Most studied answer No, the price goes down. The payments are fixed. FROM THE STUDY SET Investing View this set Other answers from study sets If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? No, the price goes down.

Certificates of deposit (CDs) | Fixed income investment | Fidelity Brokered CD vs. bank CD A brokered CD is similar to a bank CD in many ways. Both pay a set interest rate that is generally higher than a regular savings account. Both are debt obligations of an issuing bank and both repay your principal with interest if they’re held to maturity.More important, both are FDIC-insured up to $250,000 (per account owner, per issuer), a coverage …

If the yield on a fixed coupon bond goes up, does the borrower have to ... The borrower does not pay more interest. "…the yield on a fixed coupon bond goes up…" means that the price of the bond declines. If the borrower borrows $1 billion at a rate of 3%, that means (generally, more-or-less) that the borrower pays $15 million twice per year as interest.

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

.png)

Post a Comment for "40 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest"